Ensuring a Smooth Transition of Real Estate

Mr. and Mrs. Reynolds are a 60-year-old couple who have saved, invested, and built a significant and diversified portfolio of investments for themselves.

They’ve accumulated a variety of assets including stocks, currencies, commodities, and of course a diversified portfolio of real-estate.

THE PROBLEM

The Reynolds have a complex estate with multiple considerations that are beyond the scope of this case study. However, they do have one issue that we will cover…

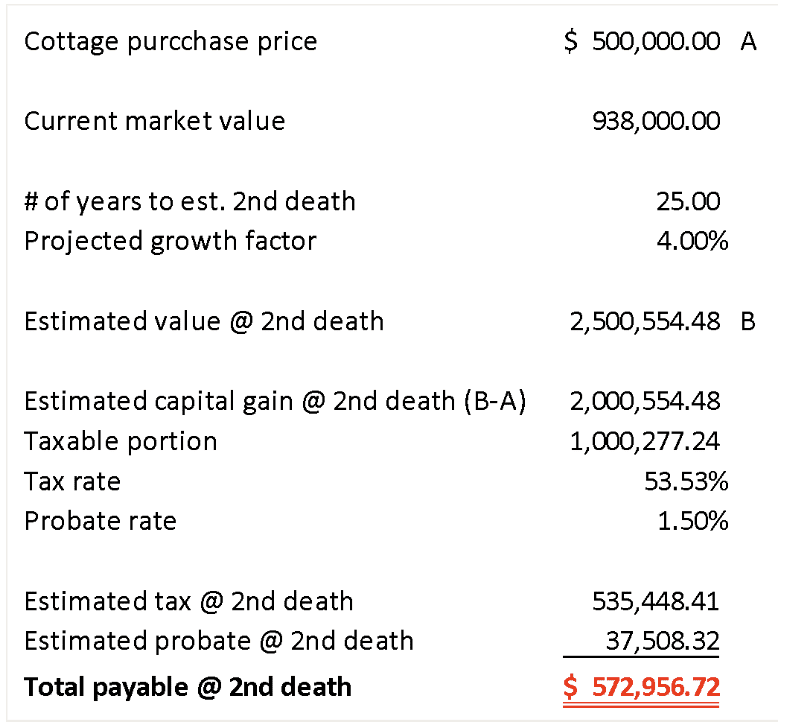

The family cottage was purchased 10 years ago for $500,000. It quickly became a central feature in the family’s social life.

The kids were in their late teens and early twenties when the Reynolds bought the property, and it is put to good use.

What’s more, the neighborhood they are in has boomed over the years with an influx of high-net-worth families purchasing adjacent properties and building/renovating their own beautiful cottages.

The Reynold’s lakefront property is in high demand, but the Reynolds have no desire to ever let the property go.

Further, the kids love it. They want to ensure they keep it in the family for generations to come.

TAXES, TAXES, AND MORE TAXES

So, here’s the problem: Taxes.

It’s well known that spouses can horizontally transfer their estates to each other without triggering taxes at death. However, intergenerational transfers trigger tax.

How much tax? Let’s look at the projected taxes owing on the Reynolds’ cottage:

Based on a modest 4% annual projected growth rate in the value of the property we are looking at a tax bill of $573,000.

That’s a lot, and that’s ONLY on the cottage!

THE SOLUTION

Coming to grips with the tax projection was difficult. There were very few solutions available other than saving the money to fund the tax bill.

The Reynolds had other plans for their other assets and were not interested in having the children fund the eventual tax bill, nor were they interested in forcing the children to re-finance the property at their eventual deaths.

The couple was in a good financial position, they were both still working and earning a strong living. They carried no personal debts other than mortgages on rental properties. They had ample savings and cash-flow and were interested in an estate transfer solution that was:

- As close to guaranteed as possible to work

- Presented as close to zero chance of loss as possible

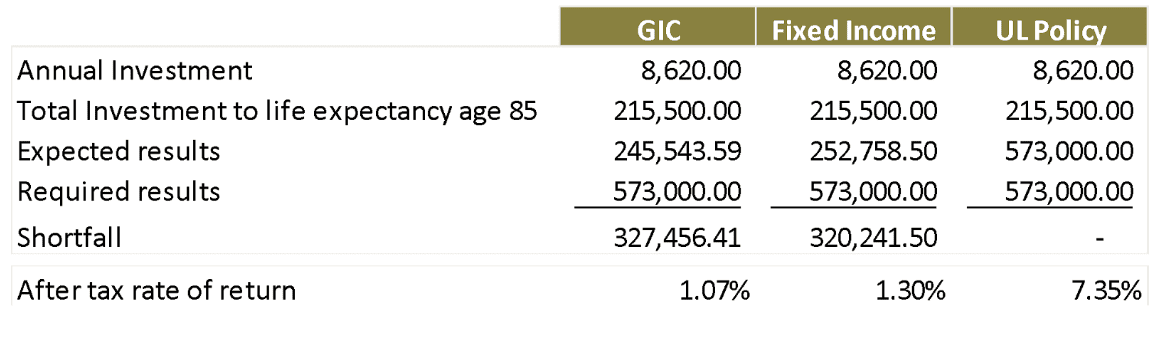

Traditional solutions that met their needs were GICs and fixed-income securities. But there were two problems with these:

- They were horribly tax inefficient

- They were not projected to return much at all

For example, according to FP Canada Standards Council’s 2022 Projection Assumption Guidelines, GICs and other “cash” type of investments had a long term projected annual return of 2.3% and fixed income of 2.8%.

Considering the Reynolds’ tax bracket, their net, after-tax returns were projected at 0.98% and 1.3% respectively. The same guidelines project long term inflation at above 2%.

The outlook was bleak.

UNIVERSAL LIFE INSURANCE

The Reynolds began looking at life insurance products to help solve their problem. They had experience with more traditional policies such as term and whole life policies and in fact owned each. Their term policies were set to expire and their whole life policy was already paid up and ear-marked for other purposes.

However, neither of these types of financial products were adequate for their needs.

- Term insurance was not permanent, they needed permanent coverage to meet their future tax obligation

- Whole life insurance, although attractive, was more expensive than they were prepared for

In came Universal Life (UL).

Universal life Insurance is a hybrid financial product that combines lifetime insurance coverage with the long-term growth potential of tax-advantaged investing.

At its core, it is a permanent life insurance policy that allows you to over-contribute to a tax-free investment account based on legislative limits.

Now, the Reynolds were not currently interested in the investment account, they already had a diversified portfolio of investments. They were, however, interested in the following features:

- Lifetime Coverage: for a fixed premium, UL policies can be designed to provide a fixed benefit for life that cannot be cancelled or changed

- Tax-Free Benefit: the death benefit of a UL policy, when stripped away from complexities, is received by the estate or beneficiaries tax-free

- Death Benefit Options: UL policies can be structured to have level or increasing protection. The level protection feature was attractive to them.

- Flexibility: With their other policies paid-up and no remaining option to increase coverage, the couple found it beneficial that the UL policy did provide the option for additional contributions down the road.

THE POLICY

The Reynolds settled on a Universal Life Policy with the following characteristics:

- Fixed amount of permanent insurance: $573,000

- Joint last-to-die, costs to last death

- This led to a Joint equivalent age of 49!

- Level cost of insurance to age 100

The overall cost of the policy was $8,619.60 per year.

In comparison to their alternatives (GICs and fixed income) it was a no-brainer…

The UL policy gave them exactly what they needed…

- Guaranteed results

- No guessing

- Tax-efficient results

- Flexibility to improve the results if needed

The PRE-TAX equivalent rate of return required to match the UL policy’s projected performance would be 15.81%. Not sure if you’ve checked GIC rates recently, but that’s highly unlikely.