How Death and Disability Can Affect Young Real Estate Investors

Death and disability are no one’s favorite topic, but they do occur, and they often occur at the worst possible time.

Younger real estate investors are often busy, busy, busy!

Young kids, work, side-gigs, and of course a newly acquired portfolio of rental properties all eat up your time and cash-flows, leaving you with no energy or cash at the end of the day to consider building up a significant pool of emergency funds.

This is all great when you’re healthy, but what if you’re not?

The financial risk to such families stems primarily for the lost earning potential when the family is not yet financially established.

This can be a massive undetected risk for your finances, like a hidden cancer wreaking havoc on your long-term financial plan.

For example…

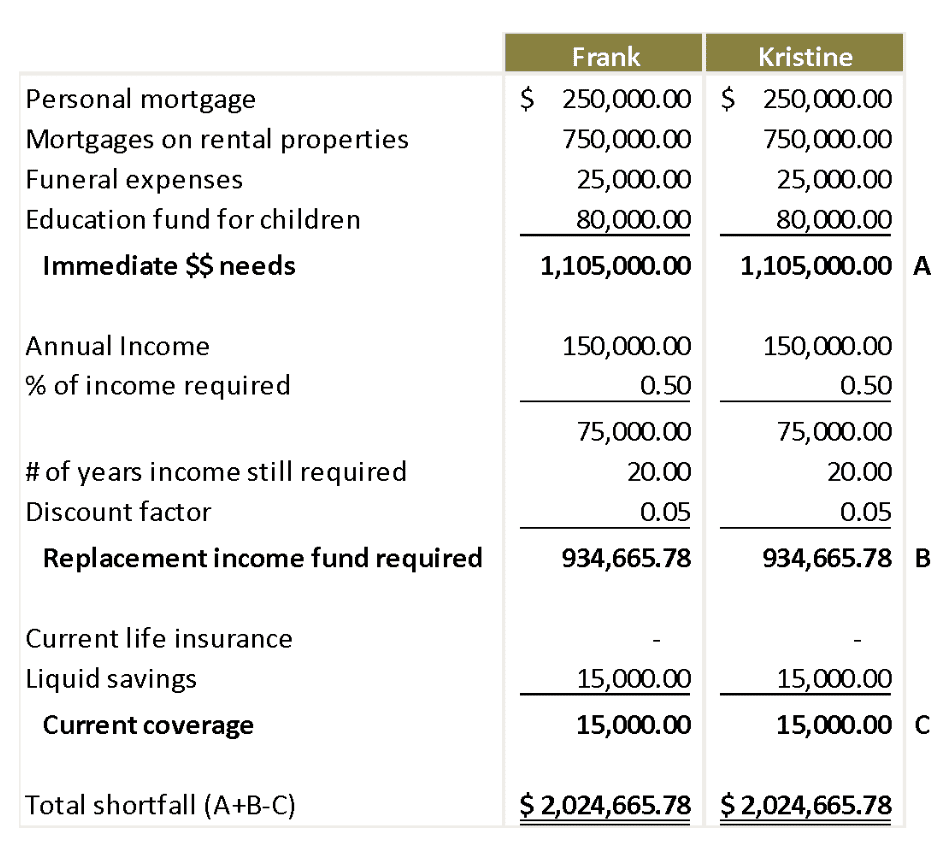

Frank and Kristine are a 40-year-old couple:

- Frank works as an IT manager for a major bank earning $150,000 per year

- Kristine works as an HR manager for a mid-sized professional firm earning $150,000 per year

- Both are healthy, non-smokers

- Own their home (mortgaged) and two rental properties (mortgaged)

- Have some RRSP/RPP savings and no TFSA or RESPs

- 2 kids aged 5 and 8

- Not much in the form of emergency savings and only limited access to an unsecured line of credit

The financial cost of early death or disability to either Frank or Kristine would be DEVASTATING.

Have a look at the figures below…

The death of either spouse would create an immediate cash need of roughly $2,000,000! Without this type of savings, the family would experience a significant decrease in their financial well-being and likely derail their long-term financial plans.

Further, a major illness or disability could leave either spouse unable to work, cutting their earnings to zero and they would still need financial support to maintain themselves.

In fact, the chances of either spouse becoming disabled are higher than death, and the financial consequences could be even worse!

SOLVING THE PROBLEM

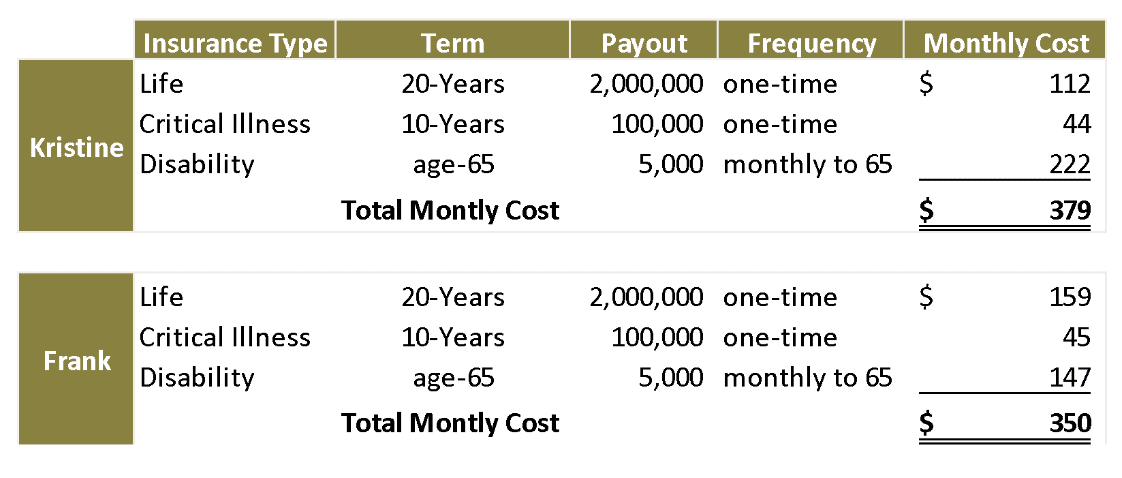

Saving $2,000,000 is both impractical and impossible for this couple. Yet, accessing this type of money in a catastrophe would be necessary to ensure the family maintains its standard of living.

Rather than attempting to fund the risk themselves, the smarter move would be to use insurance to cover the risk.

Life insurance is simply a contract between an insurance policy holder and an insurer, where the insurer promises to pay a designated beneficiary a sum of money upon the death of an insured person.

In a similar manner, Critical Illness insurance and Disability Insurance are contracts between a policy holder and an insurer, where the insurer promises to pay a designated beneficiary a sum of money (or a series of periodic sums in the case of Disability Insurance) upon the diagnosis of a Critical Illness or occurrence of disability of an insured person.

Life, Critical Illness, and Disability Insurance allow individuals to pool their risk of financially punishing outcomes together, thereby spreading the risk among many individuals.

The result is both AFFORDABLE and EFFECTIVE.

In the case of Frank and Kristine, simply setting aside a mere 3% of their annual income provides them with the coverage they need in the worst possible case scenario.

Further considerations

But we don’t end it there.

One of the beautiful things about the term life insurance policies that Frank and Kristine chose is the convertibility feature.

Most major life insurance companies allow their term policies to be converted to permanent policies within the first 5 years of the policy, without additional medical underwriting.

As Frank and Kristine continue down their real-estate journey, they will inevitably begin to grow their wealth through smart investing, hard work, possible inheritance, etc. etc.

When the time is right, and the cash flow allows, the couple can convert their term policies to permanent policies and employ more complex financial and estate planning techniques.