The Problem

You’re about to retire, you’re going to be living off a nest egg that took decades of saving and investing to build.

Now it’s time to decide what you’ll be investing in to sustain that nest egg well into your golden years allowing you to travel, enjoy life, maintain yourself if you require additional help, and, hopefully, leave a bit to your children and grand children.

The general rule of thumb is that you can draw about 4-5% from your investment pool on an annual basis to supplement your government pensions whilst maintaining your retirement portfolio without the risk of depleting your finances.

But wait, who came up with that rule of thumb in the first place? Your mom is 90 and she’s not in bad shape at all. Heck, it’s not inconceivable that she may live to 100.

Medicine has improved since that “rule of thumb” was created. Seniors are active, they work out, they take courses to stimulate their minds, they have access to excellent health care: Simply put, they live longer than expected.

A 30-year retirement is not unimaginable anymore. What about inflation? Will your money last that long? Will you have to sell your house and downsize?

You start crunching numbers. GICs are paying anywhere from 1-2.5% now (2022), government bonds aren’t much more attractive. Savings accounts? Don’t even talk about those, they’re a joke.

All these “safe” investments are paying less than inflation after tax.

That’s when you start looking at alternatives. Maybe stocks? Some have dividends exceeding 5%.

Maybe real estate? Too bad you don’t have enough for a down-payment, and condos in Toronto aren’t even cash-flow positive for the most part.

You’re confused.

Exactly what rate of return do you need to support yourself through a potentially long retirement?

Why “Rate of Return” is Actually Meaningless

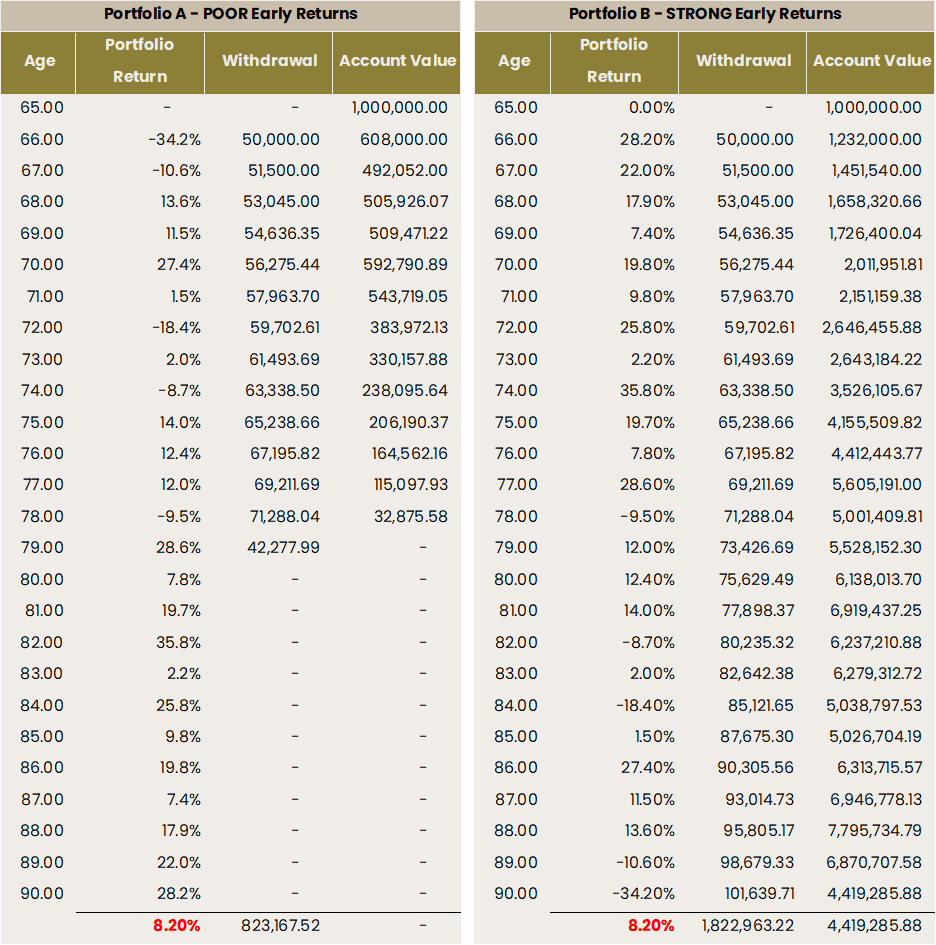

Let’s look at two investment options.

John, age 65 and in good health, has $1,000,000 saved in his retirement portfolio. He would like to draw $50,000 per year adjusted for inflation, on an annual basis from this portfolio to supplement his CPP and OAS pensions.

He has two options:

- Portfolio 1 has a historical compound, annual rate of return of 8.2%

- Portfolio 2 has a historical compound, annual rate of return of 8.2%

Which one should he go for?

Right now, you’re asking yourself if this is a trick question. They both have the same long-term rate of return, so they’re the same, right?

WRONG.

Let’s take a closer look…

Although they have the same long-term performance (8.2% compound annual return) they have drastically different outcomes.

Take a closer look. Portfolio B starts off strong, while portfolio A starts off with significant losses.

Portfolio B is the exact inverse of portfolio A. Strong at first but finishes with losses in the end.

The early losses suffered by portfolio A have a significant effect on the longevity of John’s retirement portfolio. In fact, he runs out of money by age 79.

In comparison, portfolio A allows John to sustain himself with an increasing draw every year until his eventual passing at age 90. It even allows him to leave his children over $4,400,000 at death, over 4-times what he initially invested even though he enjoyed over $1,800,000 of additional income over the course of his 25-year retirement.

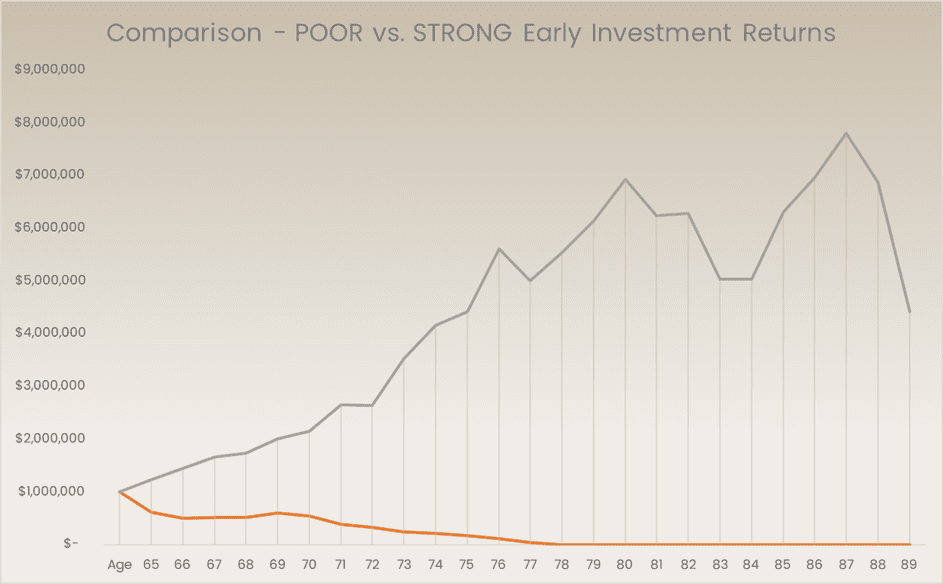

The chart below demonstrates this visually:

So, What’s the Lesson Here?

The overall lesson is this: It’s more complicated than you think.

Looking at historical returns ONLY is a huge mistake that many retirees and investors make.

Returns must be viewed in context. You must consider:

- Variation of returns

- Risk of loss

- Annual withdrawals

Among many more factors.

How Do I Avoid These Problems?

There are several ways you can avoid these problems, many of which will be topics in future blog posts:

Diversification of investments:

You can diversify between long-term assets such as stocks and blend in some lower risk assets such as short-term debt, GICs, cash savings etc. which can dampen short term losses on your portfolio and fund your more current needs.

Choose lower volatility investments:

You can allocate your portfolio to lower volatility investments such as low duration fixed income and similar investments. However, you will be sacrificing long term gains for this type of strategy and run the risk of outliving your money.

Use Insured Products:

Insurance investments, such as segregated funds and related products provide many features such as principal guarantees, return guarantees and similar investment features that many retirees find attractive. These products tend to have a higher price tag than traditional investment vehicles but can offer peace of mind.

The bottom line: It’s more complicated than you think, and a full analysis should be undertaken before you pull the trigger on any retirement strategy.

Fabio Campanella CPA, CA, CFP, CIM is an independent investment advisor with Queensbury Securities Inc. along with being the CEO of The Campanella Group. He has helped hundreds of families plan their tax, investment, and estate strategies since 2002.

If you’re ready to take the next step in your financial journey then contact us for a zero-cost 30-minute, online meeting where we can get to know you and determine if we can help you pave a path toward financial success.